The United States experienced a slowdown in economic growth in the first quarter of the year, falling below the Federal Reserve’s estimates of the economy’s long-run potential for the first time in almost two years. This decrease in growth was accompanied by fast inflation, presenting a challenging situation for the central bank to navigate. The

Deutsche Bank recently reported a 10% increase in first-quarter profit, surpassing expectations and sending its shares soaring to a more than six-year high. The German lender’s net profit attributable to shareholders stood at 1.275 billion euros, exceeding the aggregate analyst forecast for the period. This marked the bank’s highest first-quarter profit since 2013 and its

The proposal for utilizing future interest on frozen Russian assets to aid Ukraine is gaining momentum among the Group of Seven nations. This strategy aims to provide a steady stream of funding for Ukraine by collateralizing the interest earned on the frozen Russian assets. However, there are still contentious issues within the G7 regarding certain

The Gold price has seen some upward movement amid a modest USD downtick recently, but the momentum lacks follow-through. A softer risk tone has also provided support to the precious metal, although the hawkish expectations around the Federal Reserve have capped any significant gains. Traders are closely watching the upcoming US macroeconomic data releases to

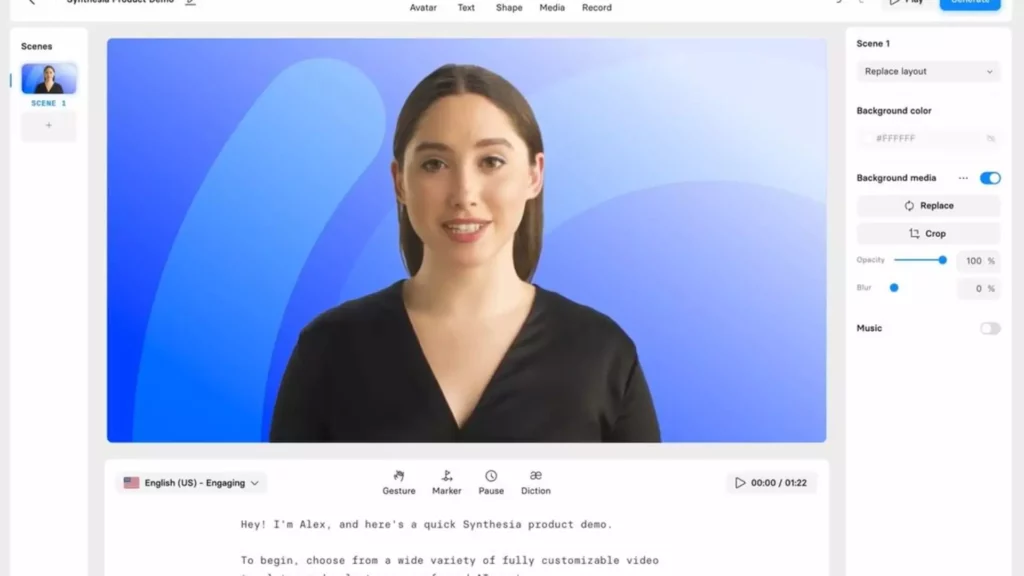

Nvidia-backed AI firm Synthesia has introduced a groundbreaking technology that involves AI-generated digital avatars capable of expressing human emotions through text inputs. This innovative technology is aimed at bridging the gap between the virtual world and real characters, revolutionizing the traditional video production process by eliminating the need for cameras, microphones, actors, and extensive editing.

The US 100 cash index is currently in the red, trading slightly below the 100-day simple moving average. Despite recent positive earnings, market sentiment remains bearish as investors await key US data releases. Momentum indicators are mostly bearish, with the Average Directional Movement Index (ADX) pointing towards a bearish trend and the Relative Strength Index

This week’s economic data releases have kept investors on edge, especially in light of the Federal Reserve’s monetary policy decisions. The S&P Global Flash manufacturing PMI for the U.S. dropped to a four-month low of 49.9 in April, signaling a contraction in the sector. As economists anticipate GDP and PCE price index readings, projections point

The U.S. prosecutors are pushing for a harsher sentence of 36 months for the former CEO of Binance, a cryptocurrency exchange, on charges related to enabling money laundering. The sentencing memorandum submitted to the court in the western district of Washington argues that the CEO should face a higher sentence to account for the gravity

When considering the trends exhibited by WTI oil futures, it is clear that a bullish channel has been maintained since December. This bullish trend has been evident since the price reached a low of 69.97 and surged to a six-month high of 86.90 on April 12. Despite a recent pullback from this peak, the price

Xiaomi, a well-known Chinese smartphone company, has stepped into the electric vehicle market and has seen remarkable success with its new electric SUV model. With more than 70,000 orders received for its latest electric vehicle, the SU7 sedan, Xiaomi is on track to surpass its initial full-year delivery target. The company’s CEO, Lei Jun, revealed

Gold prices have shown minimal movement recently, hovering in a narrow band as traders closely watch for any developments in U.S. economic data. Despite a slight increase to $2,325.23 per ounce, the overall market sentiment remains cautious. The anticipation of upcoming GDP and PCE reports has heightened, with the potential to impact the dollar and

The European markets have been experiencing strong business activity indicators, leading to a rise in the value of the euro above $1.07. This positive trend has been encouraging for investors, displaying a promising outlook for the region’s economy. The increase in business activity suggests a growing and thriving market environment, which could attract more investment

- 1

- 2

- 3

- …

- 65

- Next Page »